Gold hovered close to its lowest in nearly six years on Thursday, as the dollar held at multi-month highs and US economic data reinforced market expectations of an interest rate hike this year.

Spot gold was little changed at $1,071.96 an ounce by 0245 GMT (6.45am UAE time), after dropping 0.4 per cent on Wednesday. The metal dipped to $1,064.95 last week, the lowest since February 2010.

The dollar index, a measure of strength against a basket of major currencies, held near 100.17, an eight-month high reached in the previous session, hurting gold.

A stronger greenback makes dollar-denominated gold expensive for holders of other currencies, while higher rates could dent the appeal of non-yielding bullion.

Data on Wednesday showed that US manufacturing output rose well above economists' expectations in October, while business spending plans surged. New applications for unemployment benefits dropped last week.

Other data showed only a small increase in US consumer spending in October, but did little to alter views that the economy was strong enough for the Federal Reserve to raise rates at its next policy meeting in December.

“We are keeping an eye on the dollar as a possible catalyst (for gold)," ScotiaMocatta analysts said in a note.

“The dollar index is within reach of the multi-year high of 100.39. A break of this level would put downside pressure on gold with a break of $1,066 yielding initial $1,045, which is the 2010 low," they said.

The 100.39 level, last reached in March this year, would be the dollar index's highest since April 2003.

Gold had seen some safe-haven bids earlier in the week after Turkey downed a Russian fighter jet, stoking tensions between the two countries, but have faded since as investors fretted over the US rate hike.

Any worsening of tensions could see investors seeking safety in bullion. Russia sent an advanced missile system to Syria on Wednesday to protect its jets operating there and pledged its air force would keep flying missions near Turkish air space.

Liquidity is likely to be thin on Thursday as the US markets are shut for the Thanksgiving holiday.

In the physical markets, buying interest picked up as gold prices stayed near multi-year lows.

Premiums on the Shanghai Gold Exchange, a proxy for demand in top consumer China, were trading at a healthy $5-$6 an ounce on Thursday, versus $3-$4 in the beginning of the month. (Reuters)

Gold rates for November 26, 2015

|

Daily |

9:30am |

2:00pm |

5:00pm |

8:00pm |

|

TT Bar |

14800 | 14770 | 14770 | 14770 |

|

24k |

129.25 | 129.00 | 129.00 | 129.00 |

|

22k |

122.50 | 122.25 | 122.25 | 122.25 |

|

21k |

117.25 | 117.00 | 117.00 | 117.00 |

|

18k |

100.50 | 100.25 | 100.25 | 100.25 |

Silver eased 0.4 per cent, after slumping to $13.86 on Monday, the lowest since August 2009. Platinum on Tuesday hit $835.55, its lowest since December 2008.

The dollar hit an eight-month high on Monday on hopes of a rate hike. A firm greenback makes dollar-denominated commodities more expensive for holders of other currencies.

Premiums on the Shanghai Gold Exchange, a proxy for physical demand in China, were at $5 an ounce on Tuesday, versus $3-$4 in the beginning of the month.

Investment demand, however, was lacklustre.

Assets in SPDR Gold Trust, the world's largest gold-backed exchange-traded fund (ETF), tumbled to 655.69 tonnes on Monday, the lowest since September 2008.

Holdings of platinum ETFs are at a two-year low, while assets in palladium funds are close to their lowest since April 2014.

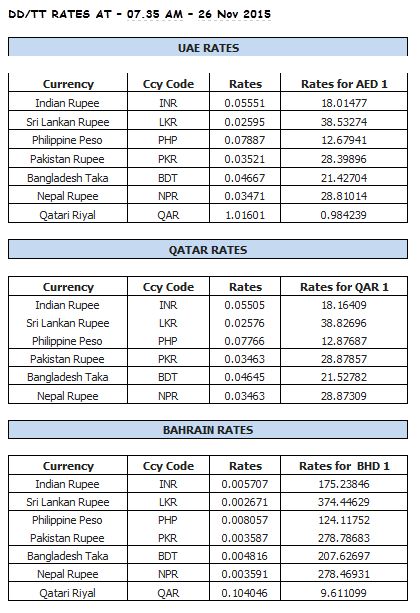

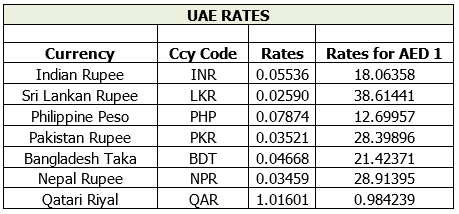

DD/TT RATES AT 03.45 PM - 26 Nov 2015

Weekly Gold Rates

|

Weekly rates |

Saturday |

Sunday |

Monday |

Tuesday

|

Wednesday

|

Thursday

|

Friday

|

|

TT Bar |

16430 | No | 16460 | 16530 | 16610 | 16130 | 16620 |

|

24k |

143.50 | Trading | 143.75 | 144.25 | 145.00 | 141.00 | 145.00 |

|

22 k |

136.25 | 136.50 | 137.00 | 137.50 | 133.75 | 137.50 | |

|

21 k |

130.50 | 130.75 | 131.25 | 132.00 | 128.25 | 132.00 | |

|

18 K |

113.00 | 113.25 | 113.50 | 114.00 | 111.00 | 114.00 |

Get retail Gold and Forex rates with Emirates 24|7

Rates will be updated twice daily

Emirates 24|7 brings you the daily Dubai gold rate (22k, 24k, 21k and 18k), as well as currency exchange rates, including the Indian rupee, Pakistani rupee, Philippine peso, Sri Lankan rupee, sterling pound, euro and may more against the UAE dirham (US dollar).

The rates for 24 carat, 22 carat, 21 carat, 18 carat and Ten Tola (TT) Bar (11.6638038 gram) will be updated four times a day to keep them fresh and relevant for buyers of gold bars and gold jewellery in the UAE.

The update times for Retail Gold Rate in Dubai will be at 9.30am, 2.30pm, 5pm and 8pm (unless there is drastic fall or rise in the international rate).

On Saturdays, the gold rates will be updated at 9.30am and this rate will stay static through Saturday and Sunday until the international market reopens on Monday.

Please note that the retailers add making charges separately to the quoted rate of gold.

The Retail Gold Rate in Dubai is being supplied by the Dubai Gold and Jewellery Group.

Foreign Exchange Rates

The Foreign Exchange Rates of major currencies will be updated twice each working day at around 8:30am and 3:30pm.

These will cover both the Remittance Rates [for sending money] and the Currency Notes Rates [for buying and selling of currency notes].

The Foreign Exchange Rates are being supplied by UAE Exchange.