Gold dipped towards its lowest level in nearly six years on Friday and was on track for a sixth straight weekly decline, weakened by a robust dollar and expectations of a US interest rate hike next month.

The dollar is trading near an eight-month high against a basket of major currencies, boosted by euro weakness and prospects of higher US rates.

The Federal Reserve is widely expected to hike US rates for the first time in nearly a decade when it meets next in December.

Investors believe higher rates could dent demand for non-yielding bullion, while boosting the dollar.

"Once again, gold is unable to find a bid. Any small rally that we see is being sold into," said a Sydney-based precious metals trader.

Buying out of top consumer China has been good but has been unable to support prices, the trader said.

Spot gold had fallen 0.4 per cent to $1,067.60 an ounce by 0322 GMT, edging close to $1,064.95 reached last week, the metal's lowest since February 2010.

The metal is down nearly 1 per cent for the week. US gold futures were also headed for a sixth consecutive weekly decline.

Buying in China has picked up in recent days due to the lower prices.

Premiums on the Shanghai Gold Exchange, a proxy for demand in top consumer China, were trading at $5-$6 an ounce, versus $3-$4 at the beginning of the month.

However, other indicators of physical demand were not upbeat.

India's gold buying in the key December quarter is likely to fall to the lowest level in eight years, hurt by poor investment demand and back-to-back droughts that have slashed earnings for the country's millions of farmers.

China's net gold imports from main conduit Hong Kong fell in October from a 10-month high reached in the previous month, data showed on Thursday.

Investor sentiment was weak with precious metals funds posting their biggest net outflow last week in around four months, according to Bank of America Merrill Lynch. (Reuters)

Gold rates for November 27, 2015

|

Daily |

9:30am |

2:00pm |

5:00pm |

8:00pm |

|

TT Bar |

14715 | 14715 | 14685 | 14565 |

|

24k |

128.75 | 128.75 | 129.50 | 127.25 |

|

22k |

121.75 | 121.75 | 121.50 | 120.50 |

|

21k |

116.50 | 116.50 | 116.25 | 115.25 |

|

18k |

100.00 | 100.00 | 99.75 | 99.00 |

Silver eased 0.4 per cent, after slumping to $13.86 on Monday, the lowest since August 2009. Platinum on Tuesday hit $835.55, its lowest since December 2008.

The dollar hit an eight-month high on Monday on hopes of a rate hike. A firm greenback makes dollar-denominated commodities more expensive for holders of other currencies.

Premiums on the Shanghai Gold Exchange, a proxy for physical demand in China, were at $5 an ounce on Tuesday, versus $3-$4 in the beginning of the month.

Investment demand, however, was lacklustre.

Assets in SPDR Gold Trust, the world's largest gold-backed exchange-traded fund (ETF), tumbled to 655.69 tonnes on Monday, the lowest since September 2008.

Holdings of platinum ETFs are at a two-year low, while assets in palladium funds are close to their lowest since April 2014.

DD/TT RATES AT 03.45 PM - 26 Nov 2015

Weekly Gold Rates

|

Weekly rates |

Saturday |

Sunday |

Monday |

Tuesday

|

Wednesday

|

Thursday

|

Friday

|

|

TT Bar |

16430 | No | 16460 | 16530 | 16610 | 16130 | 16620 |

|

24k |

143.50 | Trading | 143.75 | 144.25 | 145.00 | 141.00 | 145.00 |

|

22 k |

136.25 | 136.50 | 137.00 | 137.50 | 133.75 | 137.50 | |

|

21 k |

130.50 | 130.75 | 131.25 | 132.00 | 128.25 | 132.00 | |

|

18 K |

113.00 | 113.25 | 113.50 | 114.00 | 111.00 | 114.00 |

Get retail Gold and Forex rates with Emirates 24|7

Rates will be updated twice daily

Emirates 24|7 brings you the daily Dubai gold rate (22k, 24k, 21k and 18k), as well as currency exchange rates, including the Indian rupee, Pakistani rupee, Philippine peso, Sri Lankan rupee, sterling pound, euro and may more against the UAE dirham (US dollar).

The rates for 24 carat, 22 carat, 21 carat, 18 carat and Ten Tola (TT) Bar (11.6638038 gram) will be updated four times a day to keep them fresh and relevant for buyers of gold bars and gold jewellery in the UAE.

The update times for Retail Gold Rate in Dubai will be at 9.30am, 2.30pm, 5pm and 8pm (unless there is drastic fall or rise in the international rate).

On Saturdays, the gold rates will be updated at 9.30am and this rate will stay static through Saturday and Sunday until the international market reopens on Monday.

Please note that the retailers add making charges separately to the quoted rate of gold.

The Retail Gold Rate in Dubai is being supplied by the Dubai Gold and Jewellery Group.

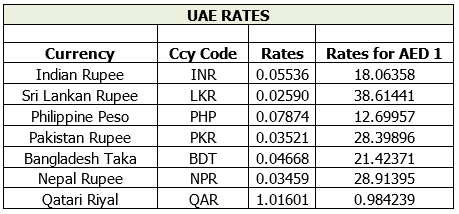

Foreign Exchange Rates

The Foreign Exchange Rates of major currencies will be updated twice each working day at around 8:30am and 3:30pm.

These will cover both the Remittance Rates [for sending money] and the Currency Notes Rates [for buying and selling of currency notes].

The Foreign Exchange Rates are being supplied by UAE Exchange.