Gold slumped to a near-six-year low on Thursday after comments from Federal Reserve chair Janet Yellen virtually cemented the case for a U.S. rate hike this month, while the strength in the dollar also pressured the metal.

Spot gold fell to $1,045.85 an ounce, the lowest since February 2010, before steadying at $1,052.35 by 0643 GMT. U.S. gold futures slid to $1,045.40, the lowest since October 2009.

Fed Chair Yellen said on Wednesday she was "looking forward" to a U.S. interest rate rise that will be seen as a testament to the economy's recovery from recession.

Yellen expressed confidence in the U.S. economy, saying job growth through October suggested the labour market was healing even if not yet at full strength.

"The market took these comments as a good indication that the Fed would raise rates at the next FOMC meeting later this month," said HSBC analyst James Steel, said referring to the Fed's Federal Open Market Committee.

A rate hike in December, widely expected in the market, would be the first in nearly a decade. Gold, as a non-interest-paying asset, would not benefit from higher rates.

"Gold is likely to remain fragile and vulnerable to the downside as investor sentiment is clearly negative," Steel said.

Yellen's comments come after expectations for a Fed rate hike at its Dec. 15-16 policy meeting were slightly shaken on the back of poor manufacturing data released earlier in the week.

However, private employment data on Wednesday was stronger than expected, adding to gold's troubles.

U.S. nonfarm payrolls data on Friday will be keenly watched for more clues.

The dollar jumped to its highest in 12-1/2 years against a basket of major currencies on Wednesday after Yellen's hawkish comments.

A stronger greenback makes dollar-denominated gold more expensive for holders of other currencies.

Investors are rapidly pulling out of bullion funds, adding to the pressure on the metal.

Assets in SPDR Gold Trust, the top gold-backed exchange-traded fund, fell 2.41 percent to 639.02 tonnes on Wednesday, the lowest since September 2008.

The outflow is the biggest single-day percentage drop in four years.

Gold prices could see another trigger later on Thursday as the European Central Bank announces its policy decision.

"Any further accommodative measures by the ECB later tonight would likely spell further downside risk for gold prices," OCBC Bank said in a note.

Gold rates for December 02, 2015

|

Daily |

9:30am |

2:00pm |

5:00pm |

8:00pm |

|

TT Bar |

14715 | |||

|

24k |

128.75 | |||

|

22k |

121.75 | |||

|

21k |

116.50 | |||

|

18k |

100.00 |

DD/TT RATES AT 03.45 PM - 1 December 2015

Weekly Gold Rates

|

Weekly rates |

Saturday |

Sunday |

Monday |

Tuesday

|

Wednesday

|

Thursday

|

Friday

|

|

TT Bar |

16430 | No | 16460 | 16530 | 16610 | 16130 | 16620 |

|

24k |

143.50 | Trading | 143.75 | 144.25 | 145.00 | 141.00 | 145.00 |

|

22 k |

136.25 | 136.50 | 137.00 | 137.50 | 133.75 | 137.50 | |

|

21 k |

130.50 | 130.75 | 131.25 | 132.00 | 128.25 | 132.00 | |

|

18 K |

113.00 | 113.25 | 113.50 | 114.00 | 111.00 | 114.00 |

Get retail Gold and Forex rates with Emirates 24|7

Rates will be updated twice daily

Emirates 24|7 brings you the daily Dubai gold rate (22k, 24k, 21k and 18k), as well as currency exchange rates, including the Indian rupee, Pakistani rupee, Philippine peso, Sri Lankan rupee, sterling pound, euro and may more against the UAE dirham (US dollar).

The rates for 24 carat, 22 carat, 21 carat, 18 carat and Ten Tola (TT) Bar (11.6638038 gram) will be updated four times a day to keep them fresh and relevant for buyers of gold bars and gold jewellery in the UAE.

The update times for Retail Gold Rate in Dubai will be at 9.30am, 2.30pm, 5pm and 8pm (unless there is drastic fall or rise in the international rate).

On Saturdays, the gold rates will be updated at 9.30am and this rate will stay static through Saturday and Sunday until the international market reopens on Monday.

Please note that the retailers add making charges separately to the quoted rate of gold.

The Retail Gold Rate in Dubai is being supplied by the Dubai Gold and Jewellery Group.

Foreign Exchange Rates

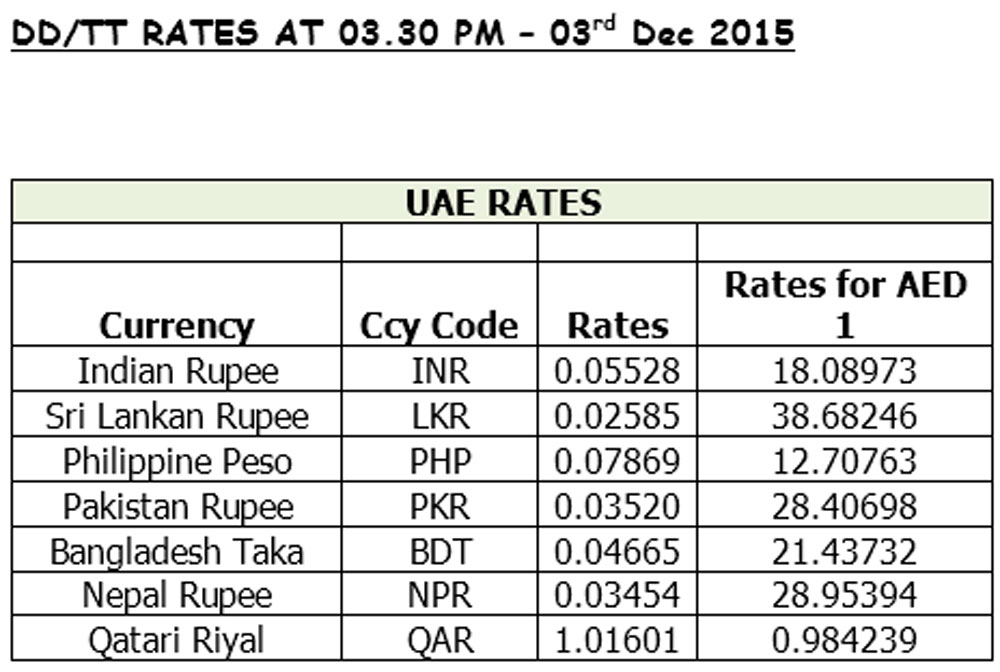

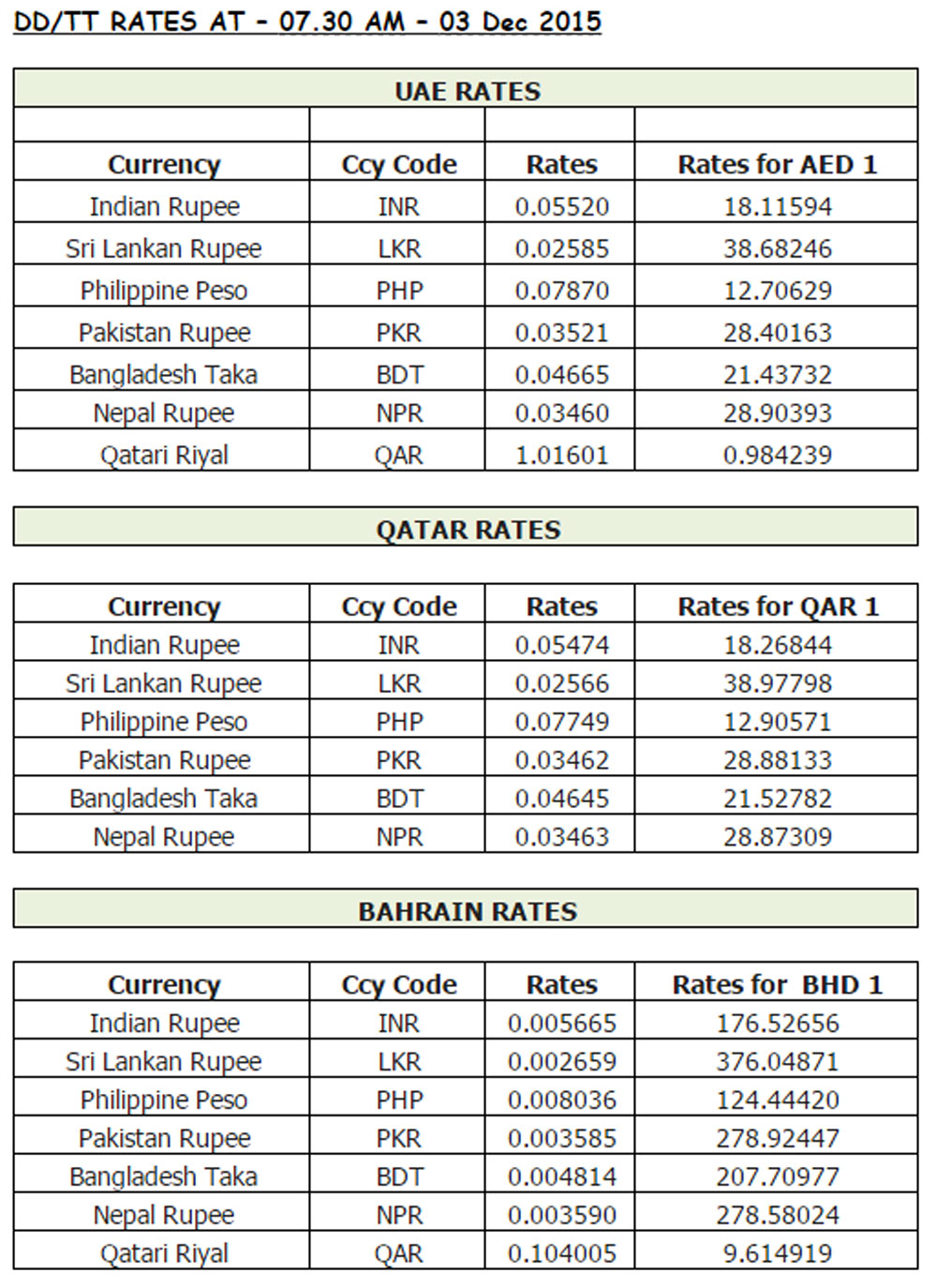

The Foreign Exchange Rates of major currencies will be updated twice each working day at around 8:30am and 3:30pm.

These will cover both the Remittance Rates [for sending money] and the Currency Notes Rates [for buying and selling of currency notes].

The Foreign Exchange Rates are being supplied by UAE Exchange.