Gulf states have agreed on key issues for implementing value-added tax in the region, an official from the United Arab Emirates finance ministry said on Monday, moving the six nations closer to introducing direct taxation for the first time.

The agreement was reached at a meeting of representatives from Gulf ministries a few days ago, Younis Haji Al Khouri, undersecretary at the UAE ministry of finance, told reporters on the sidelines of a media event.

Introducing VAT would be a major economic reform in the Gulf Cooperation Council states, which have minimal tax systems and no tax on income, although some levy fees such as road tolls.

The plunge of oil prices since last year has slashed government incomes, making it more urgent for them to find new revenue.

Khouri said the target for introducing the tax was three years, and that it would take 18 to 24 months to implement once a final agreement has been reached.

"We agreed on key issues to apply zero tax on healthcare, education, social services sectors and exempt 94 food items," Khouri said. In a couple of areas -- including financial services -- agreement was still lacking, he said.

To limit smuggling and damage to competitiveness, analysts say, the Gulf countries should introduce VAT regionally rather than individually, at different times.

VAT cannot be implemented unilaterally but has to be part of a Gulf-wide decision, Khouri told Reuters in August, adding that if all GCC states agree on a deadline, then some could implement ahead of the others.

No indication of the rate at which VAT will be levied has been given by governments, although the International Monetary Fund has suggested the UAE consider imposing VAT at a 5 per cent rate.

VAT in GCC: Gulf states agree on key issues, says UAE official

RAK chills UAE winter-seekers; Dubai beaches in no-swim mode

Latest: With the temperatures on the Jess mountain in Ras Al Khaimah at 9.6 degrees Celsius, and dropping, the UAE could see some of the lowest temperatures recorded in recent history.

Ras Al Khaimah has reported a large number of people driving to the emirate to enjoy the cold weather.

Light rain continued across the UAE, especially in the mountain areas and Lieutenant Colonel Marwan Abdullah Jakkah, Director of Public Relations and Information, RAK Police, said police patrols have been deployed on roads leading to Jess for the safety of motorists.

Light rain continued across the UAE, especially in the mountain areas and Lieutenant Colonel Marwan Abdullah Jakkah, Director of Public Relations and Information, RAK Police, said police patrols have been deployed on roads leading to Jess for the safety of motorists.

Swimming in the sea, meanwhile, is still being cited as danger, with waves forecast to be aggressive.

According to National Centre of Meteorology and Seismology (NCMS), the weather will continue to remain overcast with light rainfall and strong winds in place.

Cold Sunday: Temperatures expected to plummet

Cloud cover is expected to increase over the north later today, bringing more rainfall to parts of the country, with Al Ain, Fujairah and Ras Al Khaimah already experiencing wet weather in the morning hours; meanwhile, Dubai and Abu Dhabi also experienced drizzle in early Monday.

The NCMS further warned: “Fresh to strong northwesterly winds, especially over the sea and exposed areas, will causing blowing dust and sand and reduce horizontal visibility at times.”

A marine warning is in place for the Arabian Gulf and the Oman Sea with very rough weather giving rise to 10 feet high waves.

According to the UAE’s National Centre for Meteorology and Seismology, the lowest temperature recorded on Monday morning was 9.7 degrees Celsius at 6.15am on Jebal Jais, Ras Al Khaimah.

Dubai residents reported light rain across the emirate this morning, as foggy and overcast conditions held sway over cooler climes in the UAE.

Cloudy this in the Hor Al Anz - Mamzar area. (Pics: Shabeela Abdul Aziz)

Cloudy this in the Hor Al Anz - Mamzar area. (Pics: Shabeela Abdul Aziz)

The NCMS, the UAE weather bureau, tweeted light rain over some areas of Northern Emirates.

Daisy Clarkson tweeted @DJDaisyClarkson: "Rain this morning on the Al Ain - Dubai Road get those wipers working people!"

Another Emirates 24|7 reader reported a light drizzle at 6.40am when driving to work into Dubai.

Another Emirates 24|7 reader reported a light drizzle at 6.40am when driving to work into Dubai.

"Cloudy sky signaling more rain," the reader then tweeted.

Another reader reported at 6.30 am that a small section of lanes just before Exit 43 on Sheikh Zayed Road towards Sharjah have been closed.

Another reader reported at 6.30 am that a small section of lanes just before Exit 43 on Sheikh Zayed Road towards Sharjah have been closed.

A major accident was reported opposite Arabian Ranches before Umm Sequim Road interchange towards Abu Dhabi by @trafficdxb on Twitter.

Dubai traffic cameras now track seat-belt, mobile phone offenders

Motorists who do not use their seat belt or speak on their mobile phone while driving can no longer get away with it following the installation of new advanced police cameras in Dubai, the emirate’s traffic police chief was quoted on Monday as saying.

Colonel Saif Al Mazroui said the new cameras, deployed in and around the city, caught nearly 51,891 speed, seat belt and mobile phone offences in about 11 months.

He said the offences also include illegal overtaking, driving in hard shoulder areas and the absence of registration number plates.

“Drivers think that the cameras we have installed recently target only speedsters but they actually can detect more than a speed offence in both directions,” Mazroui said, quoted by the Dubai-based Arabic language daily ‘Emarat Al Youm’.

He said the new cameras, dubbed ‘Al Burj’ (tower), can also detect offending trucks and cars which come at close distance behind other vehicles.

“Since the beginning of this year, these cameras have recorded 21,374 hard shoulder offences.

“These are very serious offences.

“The cameras can also catch drivers who go at high speed at junctions even if the lights are green,” he said.

He said 20,780 red light offences have also been recorded in the first 11 months of 2015 while there were 6,512 offences by heavy duty trucks changing lanes.

Mazroui said 52 Al Burj cameras have been recently installed on Sheikh Zayed Rd while 31 new cameras have been deployed at junctions.

“We are focusing on Sheikh Zayed Rd given its heavy traffic nature and the high accident rate.

“In the first nine months of this year, these accidents killed 122 people compared with 131 in the same period of last year,” he said.

Miss Universe: Top 10 favourites are...

Miss Universe 2014 Paulina Vega, the Colombian beauty queen, will soon pass her crown to during the 64th edition of Miss Universe.

81 contestants have finally arrived in Las Vegas, Nevada, and all are vying to win this year's Miss Universe beauty pageant.

The current top 10 favorites from Missossology, a beauty pageant forum, include the candidates from India, Indonesia, Vietnam, Sweden, France, Philippines, Thailand, Dominican Republic, Colombia, and Japan.

The competition has just started, but fans are already anxious to see who will be crowned as the next Miss Universe.

The Miss Universe 2015 pageant night will happen at The AXIS in Planet Hollywood Resort & Casino, Las Vegas, Nevada. The show will be broadcast live by Fox on Dec. 20.

Vanessa Tevi Kumares, Miss Malaysia 2015, takes part in a pre tape segment while on stage at Planet Hollywood Resort. (AFP)

Vanessa Tevi Kumares, Miss Malaysia 2015, takes part in a pre tape segment while on stage at Planet Hollywood Resort. (AFP)

Rosa-Maria Ryyti, Miss Finland 2015; and Lisa Elizabeth Drouillard, Miss Haiti 2015; pose for a photo at Red Rock Canyon. (AFP)

Rosa-Maria Ryyti, Miss Finland 2015; and Lisa Elizabeth Drouillard, Miss Haiti 2015; pose for a photo at Red Rock Canyon. (AFP)

Yun Fang Xue, Miss China 2015. (AFP)

Yun Fang Xue, Miss China 2015. (AFP)

Aniporn Chalermburanawong, Miss Thailand 2015. (AFP)

Aniporn Chalermburanawong, Miss Thailand 2015. (AFP)

Paola Nunez, Miss Canada 2015. (AFP)

Paola Nunez, Miss Canada 2015. (AFP)

Claudia Barrionuevo, Miss Argentina 2015. (AFP)

Claudia Barrionuevo, Miss Argentina 2015. (AFP)

Urvashi Rautela, Miss India 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Urvashi Rautela, Miss India 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Paola Nunez, Miss Canada 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. The 2015 Miss Universe contestants are touring, filming, rehearsing and preparing to compete for the DIC Crown in Las Vegas. (AFP)

Paola Nunez, Miss Canada 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. The 2015 Miss Universe contestants are touring, filming, rehearsing and preparing to compete for the DIC Crown in Las Vegas. (AFP)

Ariadna Gurierrez, Miss Colombia 2015 poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Ariadna Gurierrez, Miss Colombia 2015 poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Cynthia Samuel, Miss Lebanon 2015 poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Cynthia Samuel, Miss Lebanon 2015 poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Catalina Morales, Miss Puerto Rico 2015, poses during registration at the Planet Hollywood Resort & Casino in Las Vegas on December 3rd, 2015. (AFP)

Catalina Morales, Miss Puerto Rico 2015, poses during registration at the Planet Hollywood Resort & Casino in Las Vegas on December 3rd, 2015. (AFP)

Annelies Törös, Miss Belgium 2015, poses during registration at the Planet Hollywood Resort & Casino in Las Vegas on on December 2, 2015. (AFP)Chennai floods drown Dubai resident in waves of anxiety, despair.

Annelies Törös, Miss Belgium 2015, poses during registration at the Planet Hollywood Resort & Casino in Las Vegas on on December 2, 2015. (AFP)Chennai floods drown Dubai resident in waves of anxiety, despair.

Miss Bolivia 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. The 2015 Miss Universe contestants are touring, filming, rehearsing and preparing to compete for the DIC Crown in Las Vegas. (AFP)

Miss Bolivia 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. The 2015 Miss Universe contestants are touring, filming, rehearsing and preparing to compete for the DIC Crown in Las Vegas. (AFP)

Mohammed meets Mohamed bin Zayed in Dubai

His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai on Tuesday met with His Highness Sheikh Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, in the presence of Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai, Sheikh Hazza bin Zayed Al Nahyan, National Security Advisor and Deputy Chairman of Abu Dhabi Executive Council, Sheikh Tahnoun bin Zayed Al Nahyan, Deputy National Security Adviser, and Sheikh Mansour bin Zayed Al Nahyan, Deputy Prime Minister and Minister of Presidential Affairs.

During the meeting, Their Highnesses Sheikh Mohammed bin Rashid and Sheikh Mohamed bin Zayed exchanged views on a number of topics relating to the well-being of citizens, security and stability of the UAE society and protection of the country's human and national gains.

Their Highnesses Sheikh Mohammed bin Rashid and Sheikh Mohamed bin Zayed stressed the need for bolstering the foundations of national, promotion of social cohesion and the authentic values of citizenship and continuing the journey of development under the leadership of President His Highness Sheikh Khalifa bin Zayed Al Nahyan to reach completion, with God's help and the determination of the capable and loyal people of the UAE.

Latest gold, forex rates in UAE: Gold set for third yearly fall

Gold struggled to recover from overnight losses on Tuesday on expectations of a Federal Reserve rate hike next week and a robust dollar.

Bullion has lost about 9.5 per cent for the year, its third straight annual decline, on expectations of the rate hike.

The metal was also hurt by a slide in commodity prices, particularly crude oil which was near 7-year lows as Opec continues to pump near record oil to defend market share.

Spot gold had ticked up 0.2 per cent to $1,071.85 an ounce by 0348 GMT (7.48am UAE time), but not far from Monday's session low of $1,069.66. The metal slid 1.5 per cent overnight.

Gold rates for December 08, 2015

|

Daily |

9:30am |

2:00pm |

5:00pm |

8:00pm |

|

TT Bar |

14770 | 14795 | 14730 | 14810 |

|

24k |

129.00 | 129.25 | 128.75 | 129.50 |

|

22k |

122.25 | 122.50 | 122.00 | 122.75 |

|

21k |

117.00 | 117.25 | 116.75 | 117.25 |

|

18k |

100.25 | 100.50 | 100.00 | 100.75 |

Investor sentiment has been downbeat. Assets in SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, tumbled 0.65 per cent to 634.63 tonnes on Monday, the lowest since September 2008.

Investor sentiment has been downbeat. Assets in SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, tumbled 0.65 per cent to 634.63 tonnes on Monday, the lowest since September 2008.

Speculators held a record high short position in COMEX gold futures and options in the week to December 1, recent data showed.

Elsewhere, China's gold reserves rose by nearly 21 tonnes last month, the biggest purchase since it began disclosing monthly data on the stockpile earlier this year, central bank data showed on Tuesday.

Among other precious metals, silver eased 0.2 per cent following a 2 per cent drop overnight. Platinum and palladium also dipped after 3 per cent drops on Monday.

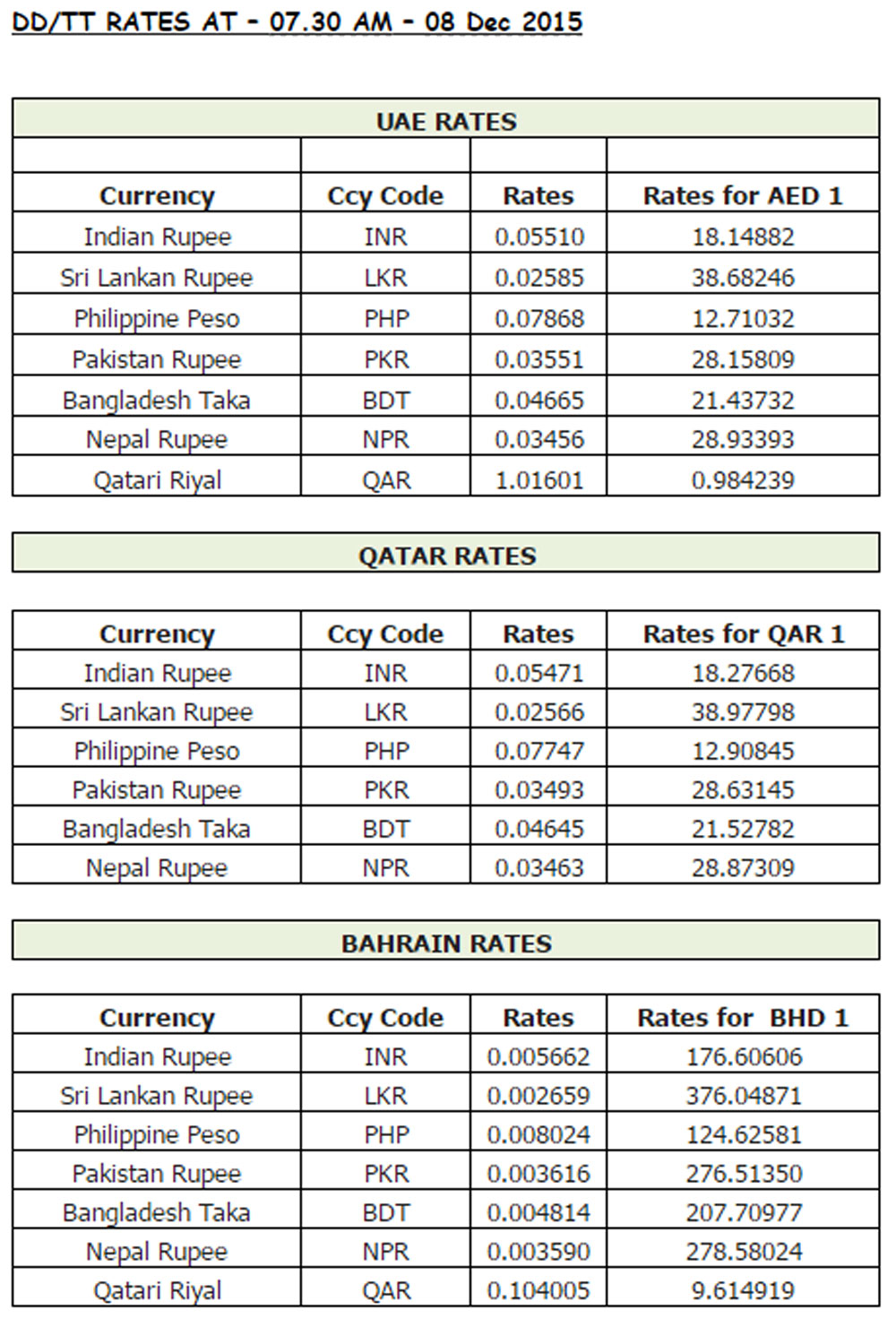

DD/TT RATES AT 3.45 PM - 8 Dec 2015

Weekly Gold Rates

|

Weekly rates |

Saturday |

Sunday |

Monday |

Tuesday

|

Wednesday

|

Thursday

|

Friday

|

|

TT Bar |

16430 | No | 16460 | 16530 | 16610 | 16130 | 16620 |

|

24k |

143.50 | Trading | 143.75 | 144.25 | 145.00 | 141.00 | 145.00 |

|

22 k |

136.25 | 136.50 | 137.00 | 137.50 | 133.75 | 137.50 | |

|

21 k |

130.50 | 130.75 | 131.25 | 132.00 | 128.25 | 132.00 | |

|

18 K |

113.00 | 113.25 | 113.50 | 114.00 | 111.00 | 114.00 |

Get retail Gold and Forex rates with Emirates 24|7

Rates will be updated twice daily

Emirates 24|7 brings you the daily Dubai gold rate (22k, 24k, 21k and 18k), as well as currency exchange rates, including the Indian rupee, Pakistani rupee, Philippine peso, Sri Lankan rupee, sterling pound, euro and may more against the UAE dirham (US dollar).

The rates for 24 carat, 22 carat, 21 carat, 18 carat and Ten Tola (TT) Bar (11.6638038 gram) will be updated four times a day to keep them fresh and relevant for buyers of gold bars and gold jewellery in the UAE.

The update times for Retail Gold Rate in Dubai will be at 9.30am, 2.30pm, 5pm and 8pm (unless there is drastic fall or rise in the international rate).

On Saturdays, the gold rates will be updated at 9.30am and this rate will stay static through Saturday and Sunday until the international market reopens on Monday.

Please note that the retailers add making charges separately to the quoted rate of gold.

The Retail Gold Rate in Dubai is being supplied by the Dubai Gold and Jewellery Group.

Foreign Exchange Rates

The Foreign Exchange Rates of major currencies will be updated twice each working day at around 8:30am and 3:30pm.

These will cover both the Remittance Rates [for sending money] and the Currency Notes Rates [for buying and selling of currency notes].

The Foreign Exchange Rates are being supplied by UAE Exchange.

Revealed: Top 10 most popular cosmetic surgeries in UAE

Cosmetic surgery has seen a surge in growth this year across the UAE, with enquiries for elective cosmetic procedures increasing by 106 per cent, according to private healthcare search engine WhatClinic.com.

The surge in interest noted can be attributed to interest from patients both at home and abroad. With its range of private hospitals and a growing reputation for quality, the UAE is a top destination for elective healthcare globally. Medical tourism makes up a significant portion of the market, and overseas enquiries rose by 135 per cent over the past 12 months.

The treatment costs an average of Dh20,981, and is not only the most popular treatment of the past year, it shows no sign of slowing down, with a 154 per cent increase in patient enquiries to clinics in the region for the same period. Rhinoplasty was the second most popular treatment, and it too is increasing in popularity, up 104 per cent. The average price tag of this surgery was revealed to be Dh23,885.

Third on the list is a relatively new procedure called gynecomastia, or male breast reduction. This procedure costs Dh21,296 on average and is becoming more popular over time. Other breast related surgeries also made the list. Breast implants (the 4th most popular treatment) and breast lift (9th most popular) both showed increased interest from patients.

The first is used to increase the size of the breast, while the latter is more common among slightly older patients, who are hoping to restore a more youthful outline. Breast lift increased by 125 per cent despite having an average price tag of Dh34,678. Implants grew by 87 per cent and had an average price of Dh26,515.

5th on the list were tummy tucks - a bariatric treatment to remove excess flesh on the abdomen - a common surgery for those who have lost a significant amount of weight. The average price for this surgical procedure is Dh33,889 and has increased by 153 per cent this year.

Fat transfer also known as fat grafting or fat injection, is one of the newer treatments generating interest among cosmetic surgery patients. Enquiries are up 169 per cent, and the treatment has an average cost of Dh21,850.

Another treatment that has become recently popular is laser vaginal rejuvenation. Enquiries rose 215 per cent over the past year, with the procedure costing Dh21,167 on average.

Demand for eyelid surgery – the procedure to correct droopy eyelids by removing excess skin, muscle or fat – has seen a considerable surge in interest over the past year as enquiries are up by 245 per cent. This procedure costs an average of Dh15,895.

Rounding off the top ten, buttock implants have also risen in popularity with a 97 per cent increase in enquiries in the past year with an average price of Dh39,500.

Although not featured on this year’s list, facelifts have been rising in popularity over the past 12 months and are likely to make the top ten in 2016. Enquiries have risen by 346 per cent since 2014, and patients can expect to pay Dh30,833, on average.

A quarter (25 per cent) of all cosmetic surgery enquiries were from overseas patients. Over the past twelve months, enquiries from Saudi Arabia have increased by 308 per cent, Oman enquiries are up 188 per cent and enquiries from Qatar have increased by 51 per cent. Further away, enquiries from UK patients have seen a 295 per cent rise in the past year.

“Over the past two years we have seen a significant increase in cosmetic surgery patients at AACSH. Patients are coming to Dubai from all over the Emirates, but also from other countries such as those in the GCC. The main reason is we have a number of international experts here, including surgeons who are American board certified, so people don’t need to go to the US. It’s easier and cheaper for patients to come to Dubai and they have access to the same level of care and expertise here, said Wima Akl, Surgical Services Coordinator at American Academy of Cosmetic Surgery Hospital, Dubai.

“Another reason for this boom is the increased access to choice and information online. Generally speaking, Internet and social media have played a huge role in the rise of this industry, and people are more comfortable talking about cosmetic surgery now. Newest technologies and techniques are also making the procedures safer, with less risks and shorter recovery times.”

Emily Ross, Director of WhatClinic.com, said: “Our data shows that cosmetic surgery is most definitely a growing market. The UAE has positioned itself as a centre of excellence for private healthcare and this investment has clearly paid off. A quarter of all enquiries are from overseas patients and this figure continues to grow, showing that the UAE is becoming a top global destination for elective procedures, and a very real alternative to US travel for patients in a number of key markets.

“We encourage all patients to do their research before they travel for any kind of procedure. Speak to a number of specialists until you find one that you are comfortable with. If you do decide to go overseas, be realistic about recovery time and getting home, and make sure you are informed about possible risks and insurance requirements.”

This data is based on actual patient enquiries made by email to UAE private clinics during 2014-15 as compared to the previous years.

'Shabab Al Manara' terrorist group: 41 on trial in UAE Supreme Court

The State Security Division of the Federal Supreme Court on Tuesday adjourned hearing of the case of the terrorist group Shabab Al Manara to 20th and 27th December 2015 and 3rd January 2016, to allow the lawyers to present their defence.

During its session yesterday, the court presided over by Judge Mohammad Al Jarrah, heard the Public Prosecution which asked for maximum punishment for the defendants.

Forty-one men are on trial charged on several counts including plotting to carry out terrorist attacks through setting up of a terrorist group with takfiri ideology under the name 'Shabab Al Manara' to carry out terrorist acts to endanger the safety and security of the country and the lives of individuals, including the leaders and symbols of the country, with the intention of causing damage to the state and private infrastructure, seizing power and changing the ruling system through the establishment of a self-proclaimed "caliphate" based on their extremist ideology and convictions.

Other counts include bringing in firearms, ammunition and explosives with the intention of carrying out terrorist acts to damage the security and interests of the state, raising funds and channelling them to terrorist organisations to help them in achieving their terrorist goals, preparing firearms, ammunition and explosives to achieve their goals, in addition to communicating with foreign terrorist organisations and supplying them with funds and recruits to achieve their goals inside the country.

The defendants also supplied terrorist groups with funds to help them to achieve their goals against a foreign state, which would endanger it and lead to cutting diplomatic relations with it.

The prosecution said three of the defendants were being tried in in absentia.

The terrorist group helped three of the defendants to join foreign terrorist organisations outside the UAE.

They also created and ran electronic sites and used IT technology to promote the ideology of the terrorist organisation (Shahab Al Manara) and spread information that would damage the national unity and social peace and undermine public order. They also used unlicensed radio communication devices.

In the previous session, defendant M.M.A. confessed to all charges while other defendants denied all of the charges.

The defendants, including one who was bailed out by the court for health reasons, appeared in court in person, along with defence lawyers and family members, and representatives of the UAE media.

3 Boeing planes left unclaimed at airport

Still puzzled by the mystery of missing flight MH370, Malaysian airport authorities now have the opposite problem: three Boeing 747 planes left unclaimed at the country's main airport.

The operators of Kuala Lumpur International Airport (KLIA) have placed a bizarre advertisement in a Malaysian newspaper seeking the owners of three 747-200F aircraft apparently abandoned there.

"If you fail to collect the aircraft within 14 days of the date of this notice, we reserve the right to sell or otherwise dispose of the aircraft" under Malaysian regulations, said the ad which ran in Monday's edition of The Star.

The notice was addressed to the "untraceable owner" of the planes.

Zainol Mohd Isa, general manager of Malaysia Airports (Sepang), which operates the facility, said the airport had been trying to contact the planes' last known owners.

He said they were "international" and not Malaysian, but declined to give further details.

"I don't know why they are not responding. There could be many reasons. Sometimes it could be because they have no money to continue operations," Zainol said.

In addition to wanting the planes to be claimed, he said the airport is seeking payment from the owners for landing, parking and other charges.

If no payment is received by December 21, the planes will be auctioned or sold for scrap to recoup the outstanding charges.

The notice gave the planes' registration numbers as TF-ARM, TF-ARN, and TF-ARH. Zainol said two are passenger aircraft and one is a cargo plane.

It is not the first time this has happened at the airport, Zainol added.

In the past decade a few other planes, mostly smaller aircraft, were abandoned.

He said an aircraft that was abandoned in the 1990s was eventually bought and turned into a restaurant in a Kuala Lumpur suburb.

KLIA was the origin of Malaysia Airlines flight MH370, which disappeared after taking off on March 8, 2014 with 239 passengers and crew aboard in what remains one of aviation's greatest mysteries.

Malaysia earlier this year confirmed that a wing part found on the French island of La Reunion in the Indian Ocean was from the plane. But no further wreckage has been found despite an intensive Australian-led oceanic search.

Miss Universe: Beauties turn the charm on

Tonie Maria Chisholm, Miss Cayman Islands 2015, Maja Cukic, Miss Montenegro 2015, Paulina Brodd, Miss Sweden 2015, Cecilie Feline Wellemberg, Miss Denmark 2015, Rosa-Maria Ryyti, Miss Finland 2015, and Jeimmy Tahiz Aburto, Miss Guatemala 2015, lead the charge during a pre tape segment at Planet Hollywood Resort. (Reuters)

Ariadna Gutierrez, Miss Colombia 2015. (Reuters)

Miss Universe 2014 Paulina Vega, the Colombian beauty queen, will soon pass her crown to during the 64th edition of Miss Universe.

81 contestants have finally arrived in Las Vegas, Nevada, and all are vying to win this year's Miss Universe beauty pageant.

The current top 10 favorites from Missossology, a beauty pageant forum, include the candidates from India, Indonesia, Vietnam, Sweden, France, Philippines, Thailand, Dominican Republic, Colombia, and Japan.

The competition has just started, but fans are already anxious to see who will be crowned as the next Miss Universe.

The Miss Universe 2015 pageant night will happen at The AXIS in Planet Hollywood Resort & Casino, Las Vegas, Nevada. The show will be broadcast live by Fox on Dec. 20.

Paulina Vega, Miss Universe 2014 (C) and the 2015 Miss Universe contestants during the Welcome Event at Planet Hollywood Resort. (Reuters)

Laura Spoya, Miss Peru 2015. (Reuters)

Gladys Brandao Amaya, Miss Panama 2015. (AFP)

Paola Nunez, Miss Canada 2015. (AFP)

Paulina Vega, Miss Universe 2014. (AFP)

Sheetal Khadun, Miss Mauritius 2015. (AFP)

Vanessa Tevi Kumares, Miss Malaysia 2015, takes part in a pre tape segment while on stage at Planet Hollywood Resort. (AFP)

Vanessa Tevi Kumares, Miss Malaysia 2015, takes part in a pre tape segment while on stage at Planet Hollywood Resort. (AFP)

Rosa-Maria Ryyti, Miss Finland 2015; and Lisa Elizabeth Drouillard, Miss Haiti 2015; pose for a photo at Red Rock Canyon. (AFP)

Rosa-Maria Ryyti, Miss Finland 2015; and Lisa Elizabeth Drouillard, Miss Haiti 2015; pose for a photo at Red Rock Canyon. (AFP)

Yun Fang Xue, Miss China 2015. (AFP)

Yun Fang Xue, Miss China 2015. (AFP)

Aniporn Chalermburanawong, Miss Thailand 2015. (AFP)

Aniporn Chalermburanawong, Miss Thailand 2015. (AFP)

Paola Nunez, Miss Canada 2015. (AFP)

Paola Nunez, Miss Canada 2015. (AFP)

Claudia Barrionuevo, Miss Argentina 2015. (AFP)

Claudia Barrionuevo, Miss Argentina 2015. (AFP)

Urvashi Rautela, Miss India 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Urvashi Rautela, Miss India 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Paola Nunez, Miss Canada 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. The 2015 Miss Universe contestants are touring, filming, rehearsing and preparing to compete for the DIC Crown in Las Vegas. (AFP)

Paola Nunez, Miss Canada 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. The 2015 Miss Universe contestants are touring, filming, rehearsing and preparing to compete for the DIC Crown in Las Vegas. (AFP)

Ariadna Gurierrez, Miss Colombia 2015 poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Ariadna Gurierrez, Miss Colombia 2015 poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Cynthia Samuel, Miss Lebanon 2015 poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Cynthia Samuel, Miss Lebanon 2015 poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Catalina Morales, Miss Puerto Rico 2015, poses during registration at the Planet Hollywood Resort & Casino in Las Vegas on December 3rd, 2015. (AFP)

Catalina Morales, Miss Puerto Rico 2015, poses during registration at the Planet Hollywood Resort & Casino in Las Vegas on December 3rd, 2015. (AFP)

Annelies Törös, Miss Belgium 2015, poses during registration at the Planet Hollywood Resort & Casino in Las Vegas on on December 2, 2015. (AFP)Chennai floods drown Dubai resident in waves of anxiety, despair.

Annelies Törös, Miss Belgium 2015, poses during registration at the Planet Hollywood Resort & Casino in Las Vegas on on December 2, 2015. (AFP)Chennai floods drown Dubai resident in waves of anxiety, despair.

Miss Bolivia 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. The 2015 Miss Universe contestants are touring, filming, rehearsing and preparing to compete for the DIC Crown in Las Vegas. (AFP)

Miss Bolivia 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. The 2015 Miss Universe contestants are touring, filming, rehearsing and preparing to compete for the DIC Crown in Las Vegas. (AFP)

UAE weather: Rain, 55kmph winds; Dubai @ 13 deg C this morning

Latest: The National Centre for Meteorology and Seismology (NCMS) has forecast rain accompanied by active winds of up to 55 kilometres per hour along the coasts.

The centre continues to hold the sea in severe turbulence, with 14ft waves not abating. The NCMS forecast that the rain will continue till tomorrow and has appealed to drivers to abide by traffic rules on the roads, leaving enough space between vehicles to avoid accidents due to low visibility.

The NCMS also forecast the fog or haze across the UAE.

Meanwhile, temperatures continued to drop with 13 degrees Celsius being recorded on the Al Ain-Meydan road this morning in Dubai.

Wet and chilly Tuesday

Light rain was reported across parts of Dubai and Sharjah at 10.30am, with the UAE’s Met office confirming the country is to expect scattered showers over the next 24 hours.

However, residents excited with the overcast skies will have to make way for the northern emirates to experience heavier rainfall, which the NCMS has stated will be more pronounced around Ras Al Khaimah and Fujairah.

Temperatures plummeted to 2.6 degrees Celsius on Tuesday morning, even as the UAE braces itself for another 24 hours of chilly weather before the Mercury rises again.

According to the latest reading by the UAE’s National Centre for Meteorology and Seismology (NCMS), the lowest temperature recorded at 5.45am at Ras Al Khaimah’s Jebel Jais mountain was 2.6 degrees, with the country overall experiencing a four-degree drop in the average mean temperatures.

More rain is also forecasted across the UAE later today, with the NCMS stating the northwesterly winds will increase cloud cover in the north, giving rise to spattering of rain, especially in Ras Al Khaimah, Fujairah and the UAE islands.

The NCMS has further stated strong winds, averaging 75kmph, could blow dust and hinder horizontal visibility in open areas.

The marine warning remains in place with 10-14 feet high waves in the Arabian Gulf, while the Oman Sea is also forecasted as very rough.

A spike in humidity levels on Wednesday could lead to some fog or mist late night and early morning, the NCMS stated.

With the temperatures on the Jebel Jais mountain in Ras Al Khaimah at 9.6 degrees Celsius, and dropping, the UAE could see some of the lowest temperatures recorded in recent history.

Ras Al Khaimah has reported a large number of people driving to the emirate to enjoy the cold weather.

Light rain continued across the UAE, especially in the mountain areas and Lieutenant Colonel Marwan Abdullah Jakkah, Director of Public Relations and Information, RAK Police, said police patrols have been deployed on roads leading to Jebel Jais for the safety of motorists.

Light rain continued across the UAE, especially in the mountain areas and Lieutenant Colonel Marwan Abdullah Jakkah, Director of Public Relations and Information, RAK Police, said police patrols have been deployed on roads leading to Jebel Jais for the safety of motorists.

Swimming in the sea, meanwhile, is still being cited as dangerous, with waves forecast to be aggressive.

According to National Center of Meteorology and Seismology (NCMS), the weather will continue to remain overcast with light rainfall and strong winds in place.

Cold Sunday: Temperatures expected to plummet

Cloud cover is expected to increase over the north later today, bringing more rainfall to parts of the country, with Al Ain, Fujairah and Ras Al Khaimah already experiencing wet weather in the morning hours; meanwhile, Dubai and Abu Dhabi also experienced drizzle in early Monday.

The NCMS further warned: “Fresh to strong northwesterly winds, especially over the sea and exposed areas, will causing blowing dust and sand and reduce horizontal visibility at times.”

A marine warning is in place for the Arabian Gulf and the Oman Sea with very rough weather giving rise to 10 feet high waves.

According to the UAE’s National Center for Meteorology and Seismology, the lowest temperature recorded on Monday morning was 9.7 degrees Celsius at 6.15am on Jebal Jais, Ras Al Khaimah.

Dubai residents reported light rain across the emirate this morning, as foggy and overcast conditions held sway over cooler climes in the UAE.

Cloudy this in the Hor Al Anz - Mamzar area. (Pics: Shabeela Abdul Aziz)

Cloudy this in the Hor Al Anz - Mamzar area. (Pics: Shabeela Abdul Aziz)

The NCMS, the UAE weather bureau, tweeted light rain over some areas of Northern Emirates.

Daisy Clarkson tweeted @DJDaisyClarkson: "Rain this morning on the Al Ain - Dubai Road get those wipers working people!"

Another Emirates 24|7 reader reported a light drizzle at 6.40am when driving to work into Dubai.

Another Emirates 24|7 reader reported a light drizzle at 6.40am when driving to work into Dubai.

"Cloudy sky signaling more rain," the reader then tweeted.

Another reader reported at 6.30 am that a small section of lanes just before Exit 43 on Sheikh Zayed Road towards Sharjah have been closed.

Another reader reported at 6.30 am that a small section of lanes just before Exit 43 on Sheikh Zayed Road towards Sharjah have been closed.

A major accident was reported opposite Arabian Ranches before Umm Sequim Road interchange towards Abu Dhabi by @trafficdxb on Twitter.

Tax-cuts to make Canada attractive immigration destination

When you are weighing your options as to where you would like to migrate taking in consideration tax incentives, Canada is probably not the first country to look at.

A popular immigration destination regardless, it will come as good news that tax rules have been amended, with some attractive new stipulations.

Any citizen or resident in Canada is tax liable from the moment of residence.

It is to be noted that the new tax rules will mainly benefit the low- and mid-income earners, while those with a high income will see a rise in payable tax.

For those earning between $45,282- $90,563, the tax rate on taxable income will be reduced from 22% to 20.5%.

Individuals earning over $200,000 will be taxed 33%.

The changes will go into effect on 1 January, 2016.

Changes to TFSA

What will be interesting for the new immigrant is the changes regarding the tax - free savings account (TFSA) that will go into effect on the same date.

The maximum amount that can be deposit per year onto this account has been set back at $5,500.

The TFSA is an interesting saving option for immigrants, as it does not require previous income in Canada. This is in contrast with the Registered Retirement Saving Plan (RRSP), where a built up of previous income is required in order to create contribution room.

Further, TFSA is a tax-sheltered saving option in the sense that withdrawals are tax-free and do not impact any other benefits and tax credits. However, contributions to TFSAs are not tax-deductible, whereas contributions to the RRSP are.

The changes made are in line with the promises of the newly elected liberal government.

[Image via Shutterstock]

Gyrocopter crashes off Dubai for unknown reasons

A gyrocopter crashed into the sea in Dubai today afternoon for unknown reasons during the FAI World Air Games Dubai 2015, organisers of the multi-descipline event announced.

"For unknown reasons the gyrocopter fell into the water at Skydive Dubai Palm Dropzone," the World Air Games Organising Committee said in a statement.

It said the pilot of the small aircraft who was involved in the incident "may have sustained injuries, the extent of which are presently unknown, and was taken to hospital for medical care."

The World Air Games, organised by the Federation Aeronautique Internationale (FAI), is currently taking place at SkyDive Dubai.

"We do not yet know what caused that accident, but an investigation has started to determine the causes and to prevent such a thing from happening again. This is being undertaken by the event organisers, together with the Dubai Civil Aviation Authority and the Dubai Police," the committee said.

The committee said it intends to make a further statement soon.

Shah Rukh Khan, Kajol in Dubai: Where to see, how to meet…

The wait is finally over as Bollywood’s golden couple are mere days away from jetting into Dubai to meet and greet fans as they embark on a blitzkrieg of promotions for their upcoming romantic drama, ‘Dilwale’.

Shah Rukh Khan and Kajol, who will reunite on-screen after five years, will be joined by co-stars Varun Dhawan and Kriti Sanon as the quartet plan a 48-hour marathon of public events and private galas that will overlap with the 12th edition of the Dubai International Film Festival (Diff).

Also joining the starry cast in Dubai will be film director Rohit Shetty.

Fans of superstar King Khan will get plenty of opportunities to catch him and his co-stars live in Dubai when they jet in during the morning hours on December 12.

Organisers have planned two separate public events across 48 hours, with Shah Rukh, Kajol and the rest of the gang also making way to the recently opened Apple Store in the Mall of the Emirates.

‘Emirates 24|7’ brings you details on where to go celebrity spotting for Bollywood’s crème de la crème this weekend.

Private jet

If you fancy yourself a true blue fan of King Khan and can manage to drag yourself out of bed in the wee hours of the morning, then the airport may be your first chance to catch Shah Rukh and Co live as they make way to the emirate.

Well-placed sources in India confirm the stars will be landing at the private jet terminal in Dubai on Saturday morning, around 5.30am, before Khan and Co will make way to their hotel for a host of events over the following two days.

Arabian Centre

At high noon, the quartet will address the media before heading at 5pm for the first of two public events at the Arabian Centre mall.

Fans who want to see Shah Rukh, Kajol and gang are advised to reach the venue by 4.30pm to avoid traffic jams and expected frenzy.

The stars will address the crowds and probably groove to a few tunes before making way for an invite-only gala dinner before heading to the Diff Filmfare ME event at the Madinat Jumeirah.

Diff gala

Those who can’t make it to Arabian Centre can make way to the film festival to catch their favourite icons.

Diff, which has collaborated with Filmfare Middle East magazine, will felicitate five iconic personalities across the movie and music industry, including Shah Rukh and Kajol.

Other stars include Fawad Khan, South Indian superstar Nivin Pauly and acclaimed Emirati director Ali F Mostafa will be felicitated on the evening.

A lifetime achievement title to renowned musician and singer Bappi Lahiri who will be presented with the award at the Madinat Jumeirah gala on the 12th December.

Apple Store

We can’t say which one of the four stars is an Apple fan, but the four stars will certainly make their presence felt when they visit the flagship store in Mall of the Emirates around 2pm.

Brace yourself, along with your iPhones, as this one’s going to be a full house we are sure.

Vox cinemas

What is a movie star event without actually heading to the movies, we ask?

Following the Apple store visit where the stars will address fans and pose for the paparazzi, they will walk over – with the help of their posse of bodyguards – to Vox Cinemas an hour later to meet and greet fans and perhaps reveal a few tidbits about ‘Dilwale’, which releases across UAE screens on December 17.

Meanwhile, die-hard fans of Shah Rukh and Kajol have a chance to meet them, as Vox is running a competition asking people to prove their love for the stars.

In a Facebook post, Vox states: ‘Like our page, share this post and tell us: What is the craziest thing you could do / have done for the ones you love?

Two lucky winners will get to meet Shah Rukh and Kajol on the 13th at VOX’.

‘Dilwale’ also stars Varun Sharma, Vinod Khanna, Kabir Bedi, Johnny Lever, Boman Irani and Sanjay Mishra.

The film is produced by Red Chillies Entertainment in association with Rohit Shetty Productions.

UAE accountants' monthly pay? Dh60K, double their global peers'

Qualified chartered accountants in the UAE earn an average monthly salary of Dh61,804, which is almost double the average monthly salary of their global counterparts at Dh31,078.

This data has been revealed in the annual salary survey conducted by the Chartered Institute of Management Accountants (Cima) in 2015.

On the other hand, the survey shows that part-qualified Cima students earn an average monthly salary of Dh14,583.

The survey also lists the salaries for other roles in the industry. An Associate draws a monthly average of Dh36,303, whereas a Fellow with over 12 years of experience holding a C-suite position receives an average monthly salary of Dh202,083.

The salary breakdown of part-qualified students reveals that individuals at management level positions draw an average monthly salary of Dh8,750 and those at strategic levels earn Dh17,500. Part-qualified students also expect an 18 per cent higher salary increase than members moving forward.

“Management accountants are increasingly sought-after, and [are] receiving increased remuneration as a result,” said Geetu Ahuja, Cima Head of GCC, Middle East.

The salary survey was conducted online by Cima between May 12 and June 8, 2015. During the study period, 125,902 Cima members and students responded internationally, including a weighted base of 1,185 from the UAE.

A previous survey by recruitment firm Robert Half International highlighted that professionals in accounting and finance with Cima qualification are sought-after in the country along with executives with ACA, ACCA skills and those experienced with accounting standards US GAAP, IFRS and SOX.

That report also stated that accounting and finance skills shortage is already concerning CFOs in the region, who report that it is increasingly difficult to find the right candidates. The vast majority (93 per cent) of CFOs say that they find it challenging to find skilled financial professionals today.

The main reason for this challenge is the lack of niche, technical experts available in the market with commercial business skills.

Looking at the roles that are most difficult to fill, CFOs state that functional areas including accounting, financial and management control, business and financial analysis and audit present the toughest challenges.

Hollywood Gossip: Justin Bieber's Instagram girl responds

Justin Bieber is hunting for this girl, can you help?

The singing sensation Justin Bieber has a social media crush on a mysterious girl.

The ‘Baby’ hit-maker wants to know her identity and has sounded his fan for a worldwide search.

A young woman, Cindy Kimberly, under the Instagram name 'wolfiecindy', admitted she was overwhelmed by the attention she received after the singer posted her image on his own account on Monday.

Charlie Sheen: Brett Rossi 'insisted' we had sex

Charlie Sheen claims his former fiancée Brett Rossi knew he is HIV positive and "insisted" they should have unprotected sex anyway.

(Bang)

(Bang)

The 'Anger Management' star is currently locked in a bitter legal battle with his former fiancée as she is claiming he was "negligent" and left her "emotionally distressed" by not revealing to her that he is HIV positive.

Court documents obtained by E! News state: "She was the one who insisted upon having unprotected sex with Sheen 'like a normal couple.' [She] claimed she was a nurse and was seeing doctors who provided her with anti-HIV medication.

"She insisted she be prescribed the same medications that Sheen was taking so they could engage in unprotected sex without the risk of Sheen transmitting HIV to her."

(Getty Images)

(Getty Images)

He also claims she wanted "revenge for breaking off the engagement and cutting her off financially" and that she is on the wrong side of the law because she "attempted to extort millions of dollars by disclosing Sheen's medical condition," against the agreement they had made.

Meanwhile, Brett - who allegedly aborted his child - insists she is only bringing the case to court because she wants "justice".

She shared previously: "I want justice. If I wanted money, I would have kept our child. If I wanted money, I would have kept quiet. I want justice.

(Getty Images)

(Getty Images)

"If he would have told me from day one, from the first time that we met, there would have never been a relationship. I never would have been sexually active with him.

"I stayed because when we had a heart to heart. I asked him, is this for real, is this what you want, is this forever, now and forever? He said yes, I want to marry you, I want to have a family with you, I want to have normal life."

Miss Universe: When the beauties get funky

Miss Bulgaria 2015 Radostina Todorova, Miss Italy 2015 Giada Pezzaioli, and Miss Venezuela 2015 Mariana Jimenez pose with Miss Universe 2014 Paulina Vega at a Chinese Laundry sponsored event at Zappos, in Las Vegas, Nevada. (Reuters)

Miss Korea 2015 Kim Seo-yeon, Miss Thailand 2015 Aniporn Chalermburanawong, and Miss Japan 2015 Ariana Miyamoto pose for photos at a Chinese Laundry sponsored event at Zappos, in Las Vegas, Nevada. (Reuters)

Miss Korea 2015 Kim Seo-yeon, Miss Thailand 2015 Aniporn Chalermburanawong, and Miss Japan 2015 Ariana Miyamoto pose for photos at a Chinese Laundry sponsored event at Zappos, in Las Vegas, Nevada. (Reuters)

Miss Sweden 2015 Paulina Brodd, Miss Denmark 2015 Cecilie Wellemberg, Miss Hungary 2015 Nikoletta Nagy, and Miss France 2015 Flora Coquerel, pose for photos at a Chinese Laundry sponsored event at Zappos. (Reuters)

Miss Sweden 2015 Paulina Brodd, Miss Denmark 2015 Cecilie Wellemberg, Miss Hungary 2015 Nikoletta Nagy, and Miss France 2015 Flora Coquerel, pose for photos at a Chinese Laundry sponsored event at Zappos. (Reuters)

Miss Great Britain 2015 Narissara Nena France and Miss Mexico 2015 Wendy Esparza film in their National Costume at Planet Hollywood Resort and Casino in Las Vegas, Nevada. (Reuters)

Miss Great Britain 2015 Narissara Nena France and Miss Mexico 2015 Wendy Esparza film in their National Costume at Planet Hollywood Resort and Casino in Las Vegas, Nevada. (Reuters)

Miss Panama 2015 Gladys Brandao Amaya takes part in a pre-tape segment at Planet Hollywood Resort and Casino in Las Vegas, Nevada. (Reuters)

Miss Panama 2015 Gladys Brandao Amaya takes part in a pre-tape segment at Planet Hollywood Resort and Casino in Las Vegas, Nevada. (Reuters)

Tonie Maria Chisholm, Miss Cayman Islands 2015, Maja Cukic, Miss Montenegro 2015, Paulina Brodd, Miss Sweden 2015, Cecilie Feline Wellemberg, Miss Denmark 2015, Rosa-Maria Ryyti, Miss Finland 2015, and Jeimmy Tahiz Aburto, Miss Guatemala 2015, lead the charge during a pre tape segment at Planet Hollywood Resort. (Reuters)

Ariadna Gutierrez, Miss Colombia 2015. (Reuters)

Miss Universe 2014 Paulina Vega, the Colombian beauty queen, will soon pass her crown to during the 64th edition of Miss Universe.

81 contestants have finally arrived in Las Vegas, Nevada, and all are vying to win this year's Miss Universe beauty pageant.

The current top 10 favorites from Missossology, a beauty pageant forum, include the candidates from India, Indonesia, Vietnam, Sweden, France, Philippines, Thailand, Dominican Republic, Colombia, and Japan.

The competition has just started, but fans are already anxious to see who will be crowned as the next Miss Universe.

The Miss Universe 2015 pageant night will happen at The AXIS in Planet Hollywood Resort & Casino, Las Vegas, Nevada. The show will be broadcast live by Fox on Dec. 20.

Paulina Vega, Miss Universe 2014 (C) and the 2015 Miss Universe contestants during the Welcome Event at Planet Hollywood Resort. (Reuters)

Laura Spoya, Miss Peru 2015. (Reuters)

Gladys Brandao Amaya, Miss Panama 2015. (AFP)

Paola Nunez, Miss Canada 2015. (AFP)

Paulina Vega, Miss Universe 2014. (AFP)

Sheetal Khadun, Miss Mauritius 2015. (AFP)

Vanessa Tevi Kumares, Miss Malaysia 2015, takes part in a pre tape segment while on stage at Planet Hollywood Resort. (AFP)

Vanessa Tevi Kumares, Miss Malaysia 2015, takes part in a pre tape segment while on stage at Planet Hollywood Resort. (AFP)

Rosa-Maria Ryyti, Miss Finland 2015; and Lisa Elizabeth Drouillard, Miss Haiti 2015; pose for a photo at Red Rock Canyon. (AFP)

Rosa-Maria Ryyti, Miss Finland 2015; and Lisa Elizabeth Drouillard, Miss Haiti 2015; pose for a photo at Red Rock Canyon. (AFP)

Yun Fang Xue, Miss China 2015. (AFP)

Yun Fang Xue, Miss China 2015. (AFP)

Aniporn Chalermburanawong, Miss Thailand 2015. (AFP)

Aniporn Chalermburanawong, Miss Thailand 2015. (AFP)

Paola Nunez, Miss Canada 2015. (AFP)

Paola Nunez, Miss Canada 2015. (AFP)

Claudia Barrionuevo, Miss Argentina 2015. (AFP)

Claudia Barrionuevo, Miss Argentina 2015. (AFP)

Urvashi Rautela, Miss India 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Urvashi Rautela, Miss India 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Paola Nunez, Miss Canada 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. The 2015 Miss Universe contestants are touring, filming, rehearsing and preparing to compete for the DIC Crown in Las Vegas. (AFP)

Paola Nunez, Miss Canada 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. The 2015 Miss Universe contestants are touring, filming, rehearsing and preparing to compete for the DIC Crown in Las Vegas. (AFP)

Ariadna Gurierrez, Miss Colombia 2015 poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Ariadna Gurierrez, Miss Colombia 2015 poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Cynthia Samuel, Miss Lebanon 2015 poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Cynthia Samuel, Miss Lebanon 2015 poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. (AFP)

Catalina Morales, Miss Puerto Rico 2015, poses during registration at the Planet Hollywood Resort & Casino in Las Vegas on December 3rd, 2015. (AFP)

Catalina Morales, Miss Puerto Rico 2015, poses during registration at the Planet Hollywood Resort & Casino in Las Vegas on December 3rd, 2015. (AFP)

Annelies Törös, Miss Belgium 2015, poses during registration at the Planet Hollywood Resort & Casino in Las Vegas on on December 2, 2015. (AFP)Chennai floods drown Dubai resident in waves of anxiety, despair.

Annelies Törös, Miss Belgium 2015, poses during registration at the Planet Hollywood Resort & Casino in Las Vegas on on December 2, 2015. (AFP)Chennai floods drown Dubai resident in waves of anxiety, despair.

Miss Bolivia 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. The 2015 Miss Universe contestants are touring, filming, rehearsing and preparing to compete for the DIC Crown in Las Vegas. (AFP)

Miss Bolivia 2015, poses for a photo during registration at the Planet Hollywood Resort & Casino in Las Vegas, Nevada on December 4, 2015. The 2015 Miss Universe contestants are touring, filming, rehearsing and preparing to compete for the DIC Crown in Las Vegas. (AFP)

Dawood Ibrahim's car and restaurant auctioned

An Indian government auctioneer will sell on Wednesday farmland, a restaurant and even a car which officials say once belonged to the country's most wanted man, fugitive Mumbai mafia boss Dawood Ibrahim.

Indian police have been unable to trace him for decades, but for as little as 4,000 rupees ($60), bidders can snap up a car he purportedly owned - a 15-year-old green Hyundai Accent sedan now parked in a working-class Mumbai suburb.

The properties, confiscated more than a decade ago, make up only a tiny fraction of Ibrahim's assets. Some have already been put up for sale but remain mostly unwanted, as buyers stay away.

On Wednesday, a crowd had gathered outside a down-at-heel south Mumbai hotel where the auction was taking place, kept outside by tight security.

Ibrahim, reported to be hiding in neighbouring Pakistan, runs D Company, a crime syndicate Indian authorities accuse of engaging in murder, extortion and weapon-smuggling.

He is also accused of financing Islamist militant groups and of masterminding bomb and grenade attacks in Mumbai in March 1993 that killed 257 people and wounded more than 700.

Ibrahim fled India in the 1980s and has since eluded the authorities, although the arrest last month of a former partner in Indonesia - Rajendra Nikalje, known as Chhota Rajan - is thought to be part of a strategy to hunt him down.

The Indian government has battled for years to confiscate properties held not only by Ibrahim but by his relatives in Mumbai, and has been held up by repeated appeals. ($1=66.7300 Indian rupees)

These Dubai buses will stop wherever you want them to stop

The Roads and Transport Authority (RTA) has introduced a shuttle microbus called Al Freej, serving residents of remote areas or areas with a high demand.

The bus route is dubbed J01 and starts in Jumeirah Village Circle (JVC), from where it travels to Al Barsha 1, 2 and 3 and up to the vicinity of Mall of the Emirates in a 12.2 km-long route, serving about 23,000 residents of these three districts of Al Barsha, said Adel Shakri, Director of Planning and Business Development of RTA’s Public Transport Agency.

The Al Freej Buses are 12-17 seaters, the size of a microbus but distinguished with the RTA logo.

“Although stops have been specified along the route, the driver may stop at any place depending on a request of a rider, provided the driver will make sure that the stop will be safe and does not undermine the safety of those on board nor road users or cause accidents,” explained Shakri.

Further, it may divert its route if a need dictates so, such as delivering elderly or disabled persons, he added.

The service proved highly popular as an efficient transport link was in high demand in certain communities in Dubai.

The service was introduced with the aim of providing mobility service to families, seniors, handicapped and housewives by lifting them from their homes to business centers, clinics, health centers, schools, recreational facilities and government offices offering a wide range of public services among others, explained the RTA.

Since it was launched in July this year, it lifted more than 50,000 riders with a daily ridership increased from 428 riders at the start of operation to as many as 765 riders three months later, recording a 79 per cent growth rate.

“The fare is payable through NOL cards [as is] standard practice in the emirate,” added Shakri.

Al Freej Bus will travel through Al Barsha 1, and pass across a number of recreational & tourist destinations such as Mall of the Emirates, Matajer, 3- to 5-star hotels, hotel apartments, restaurants, schools, and residential buildings.

At Al Barsha 2 & 3, Al Freej Bus passes by a series of residential villas mostly inhabited by Emiratis and GCC citizens, which are currently witnessing further developments including schools, hospitals, retail outlets and others,” he further added.

It is noteworthy that Al Barsha is served by several bus routes including Routes 84, 93, F29, F30, and F33, rendering Al Freej Bus a high value addition to the safe & smooth mobility aboard public buses and Dubai Metro.

VAT, corporate and personal income tax in UAE: What, how much and when…

After the recent fuel price deregulation reforms, Younis Haji Al Khouri, undersecretary at the UAE Ministry of Finance, revealed earlier this week that the GCC states have agreed on key issues for implementing VAT in the region.

The International Monetary Fund (IMF), among other international bodies, has been advising the UAE and the rest of the GCC countries to introduce taxation among several options for the government to strengthen their revenue base in order to minimise dependence on the fluctuating global oil price.

The 'low' rate of VAT as advised by the IMF is being generally seen as at or around 5 per cent.

Even as the IMF maintains that the UAE economy is resilient to low oil prices and sluggish global growth thanks to its fiscal buffers and safe haven status, the agency is suggesting the government to undertake additional reforms to boost its finances.

Primary among those suggestions are imposing a value-added tax, imposing an excise duty on the sale of automobiles, as well as a decrease in the corporate income tax levels but applying it to a much broader base.

Read: 5% VAT, 15% tax on cars: IMF advice to UAE

With agreements having been reached by members of the GCC on certain aspects of the VAT systems, the big question now is ‘when’ and not ‘if’ VAT will be implemented, and, importantly, by which country (or countries) first.

“The timeframe for implementation has still not been confirmed – however governments in the region are facing deficit budgets over the short- to medium-term due to the low oil price environment. Policymakers will be prompted to introduce the VAT regime sooner rather than later,” Finbarr Sexton - Mena Indirect Tax Leader at EY, told this website.

Is personal income tax 'on the table' too?

According to Stuart Halstead, Indirect Tax Leader at Deloitte Middle East, it isn’t just VAT that’s on the table right now but also personal income tax even as he maintains that introducing personal income tax would be the most challenging.

“Personal taxes offer a real challenge to the ‘tax free’ branding of the UAE and much of the GCC. For that reason alone, we would suggest that a near-term introduction of such taxes is very unlikely. Again though, it is difficult to predict how budgets will be funded in the long term and so such measures would, we feel, always be ‘on the table’ for discussion,” he told Emirates 24|7 in e-mailed comments.

And while Deloitte’s Halstead sees personal income tax as unlikely but not impossible, EY’s Sexton says introduction of taxation in the form of VAT should keep personal income tax concerns at bay – at least for the moment.

“Personal tax is not on the tax agenda of the UAE at present and is unlikely to be on the horizon in the near future. Introduction of indirect taxes in the guise of VAT is a tax on consumers and ultimately individuals will bear the cost of VAT as opposed to most businesses that will be in a position to recover input VAT against VAT on sales and services charged to consumers,” he says.

What is VAT, how much may be imposed, and when

The IMF maintains that VAT, which is a kind of consumption tax that the end-customer pays while purchasing a product, “would serve well as a low rate-broad base tax.”

“The VAT rate is likely to be a low rate of 5 per cent, which is consistent with the recommendation of the IMF,” says EY’s Sexton.

“It is important that there is an adequate lead time to allow companies to prepare their systems, train staff and staff up for the introduction of the VAT regime. Finance ministries will similarly need to staff up and implement sophisticated IT systems to deal with VAT collection and taxpayer monitoring and audits. A typical VAT implementation period would be 18 to 24 months – so the timeline for implementation may be 2018 or latest 2019,” Sexton maintains.

“VAT is generally viewed as the most stable revenue source, which has the least detrimental effects on investments,” states the IMF.

“In such a macro-fiscal environment as in the UAE, a low rate, for example 5 per cent, VAT could be considered,” it notes.

“Our understanding of the broader economic drivers in the region and our experience of recent implementations of the tax globally would suggest a low rate with very few exceptions (i.e., it would have a broad base). Many commentators (including the IMF) have suggested rates in the region of 3-5 per cent initially, which appear sensible,” says Deloitte’s Halstead.

“A broad-based consumption tax such as VAT would raise revenue proceeds at a low efficiency cost. At the same time, its equity implications would be relatively insignificant in such a macro-fiscal environment as in the UAE, where taxes are minimal and government expenditures are financed by oil revenue,” the IMF notes.

However, while the initial VAT rate may be ‘low,’ experts maintain that a gradual increase over time or even a higher introductory tax rate cannot be completely ruled out.

“Whilst the debt, cash and other fiscal performance measures that we often examine when attempting to establish an estimate would not necessarily demand a higher rate at this time, it shouldn’t be ruled out completely. Indeed, following implementation the rate may well increase over time to help governments balance growing budget requirements although we would expect any rate changes to be signalled well in advance,” added Deloitte’s Halstead.

Nevertheless, VAT will give a “significant and positive boost” to the tax administration, the IMF says.

VAT: What will be exempted

The multilateral agreements among GCC states appear to be those which are designed, primarily, to ensure that certain social-economic distortions often associated with VAT are minimised, says Deloitte. In particular, removing VAT from food products (94 items have been identified), healthcare and education would appear to reflect a broad desire to ensure that these vital household expenditure items are not directly impacted by a VAT in the GCC, the consultancy states.

“The indications from recent reports are that there is an intention amongst GCC members to implement the tax across the region within 3 years of formal agreement being reached on certain key principles (only a few of which remain to be settled). The UAE MoF has repeatedly said that it would give businesses between 18-24 months to prepare for implementation once a decision to implement has been reached. On that basis it may well be that the UAE implements the tax as part of a first wave of countries,” says Halstead.

Businesse or consumers - who will shoulder the burden of tax?

The impact of the new tax/es on corporates and end users will not be huge, believe experts, and VAT’s impact on business should only be compliance-related, they say.

“The introduction of VAT is likely to result in increased administrative and compliance burdens as well as additional costs. Accounting and other IT systems will also be required to be able to deal with the additional demands created by new VAT laws and regulations. Companies entering into medium to long term contracts will need to look carefully at their commercial terms and conditions to ensure that the introduction of a VAT regime is provided for,” says EY’s Sexton.

“Businesses play a vital role in the success of a VAT system; in essence they play the role of tax collector, charging, collecting and then remitting the sums collected to the tax authority at the appropriate time. In many cases businesses do not suffer an additional tax cost associated with VAT – in theory, the tax is one on consumption, not on businesses,” adds Deloitte’s Halstead.

“That being said, there is an administrative burden that businesses will have to bear and to that end proper preparation is key. For example, we have a simple checklist for businesses that highlights over [50] questions that need to be answered positively in order for a business to be ready. Businesses may also have to take the cash-flow impact of VAT into their day to day activities – an issue of particular importance for those involved in major projects with tight margins,” he notes.

“For individuals there will be cost inflation on products and services purchased,” EY’s Sexton says.

“Individuals are the ones that generally bear the cost (partially or wholly) of a VAT. At a low rate, the impact on consumers is likely to be relatively benign and of course businesses may themselves mitigate the impact further by absorbing some of the VAT charge into existing profit margins,” adds Deloitte’s Halstead.

“Importantly, there are clear signals from the GCC that they are attempting to tackle some of the potentially regressive aspects of the tax by removing the VAT charge from certain food items, healthcare and educational services. These is good news for those spending heavily on those items,” he notes.

Corporate income tax plus VAT?

In addition, analysts maintain that even as the IMF has suggested a broadening of corporate tax base in the UAE to include local firms (currently, a corporate income tax of 20 per cent is levied only on foreign banks in Dubai), logistics of implementation would suggest that this may not happen simultaneously with the introduction of VAT.

“It is unlikely that VAT and corporate tax would be introduced simultaneously in the UAE – introduction of both these tax regimes represents a major challenge for any country, and with the UAE having no pre-existing taxpayer database, there is much to achieve in coming years and many challenges to be overcome,” says Sexton.

Deloitte’s Halstead agrees that it is unlikely, but is quick to add that such a move should not be completely ruled out.

“Although the corporate tax regime in the UAE is relatively limited at this time we can foresee certain structural challenges associated with any extensive broadening of the existing corporate tax base or any rate increases. Nevertheless, that is not to say that such a measure should be necessarily ruled out absolutely,” he says.

“Indeed, many corporates generating profits in the UAE may well be paying tax on those earnings back ‘home’ wherever that may be; capturing a portion of that tax here in the UAE might not actually increase their overall global tax burden at all and there is of course international pressure to extend corporate tax bases in countries with traditional low tax regimes,” he adds.

“One other aspect worth highlighting is that simultaneous introduction of two taxes requires the alignment and delivery of two programmes of related but different implementation paths, whereas separation might reduce the overall risk,” Halstead claims.

“Looking beyond the UAE there have been examples of the expansion of corporate taxes although in most cases that is against the background of an already extensive corporate tax regime that has been in place for many years,” he explains.

Current tax structure in UAE

As of now, the UAE’s tax structure as stated by the IMF report is as follows:

* A corporate income tax of 20 per cent is levied on foreign banks in Dubai;

* A local municipal property tax of 5 per cent of the rental value;

* A 10 per cent local hotel tax on hotel services;

* The GCC’s common external tariff (a general rate of 5 per cent, 50 per cent on alcohol, and 100 per cent on tobacco) applied locally;

* Select fees on government services (applied by the federal and Dubai governments).

Excise duty on passenger vehicles

In addition, the IMF noted earlier this year in August that taxing passenger cars may also be under consideration to boost UAE government revenues. “Excises on passenger vehicles could also be considered for raising non-oil revenue,” it maintains.

“Automobiles impose a number of costs on society. These costs include direct costs such as the cost of maintaining and expanding a network of roads, and indirect costs such as productivity losses due to traffic jams and health costs because of increased pollution,” it explains.

“Imposing an excise tax on automobiles would shift costs associated with the usage of automobiles to the owners. Ad valorem tax of 15 per cent would yield 0.6 per cent of non-hydrocarbon GDP,” the IMF states, adding that “gains from excises on tobacco and alcohol would be insignificant”.

Broader base for corporate income tax

According to the agency, a corporate income tax with broader coverage but lower rates would raise additional revenue and would be seen as more equitable by foreign investors.

It suggests halving the corporate income tax rate from the current 20 per cent but applying it to all non-free zone entities.

“The tax rate could be lowered to 10 per cent from the current 20 per cent and the coverage could be broadened by including all companies (foreign, domestic, GCC) except for those located in free economic zones. In addition, a broadened corporate income tax, if applied to unincorporated companies, could provide some progressivity in taxation and would lessen the need to introduce a general income tax on individuals,” it notes.

“This measure is estimated to yield 4.1 per cent of non-hydrocarbon GDP,” the IMF reckons.